The primary goal of Dr. Tom Chesser is to inspire readers to embark on their journey to Success. Each story shared in the series serves as a source of motivation, offering valuable insights & lessons that can be applied to all aspects of life.

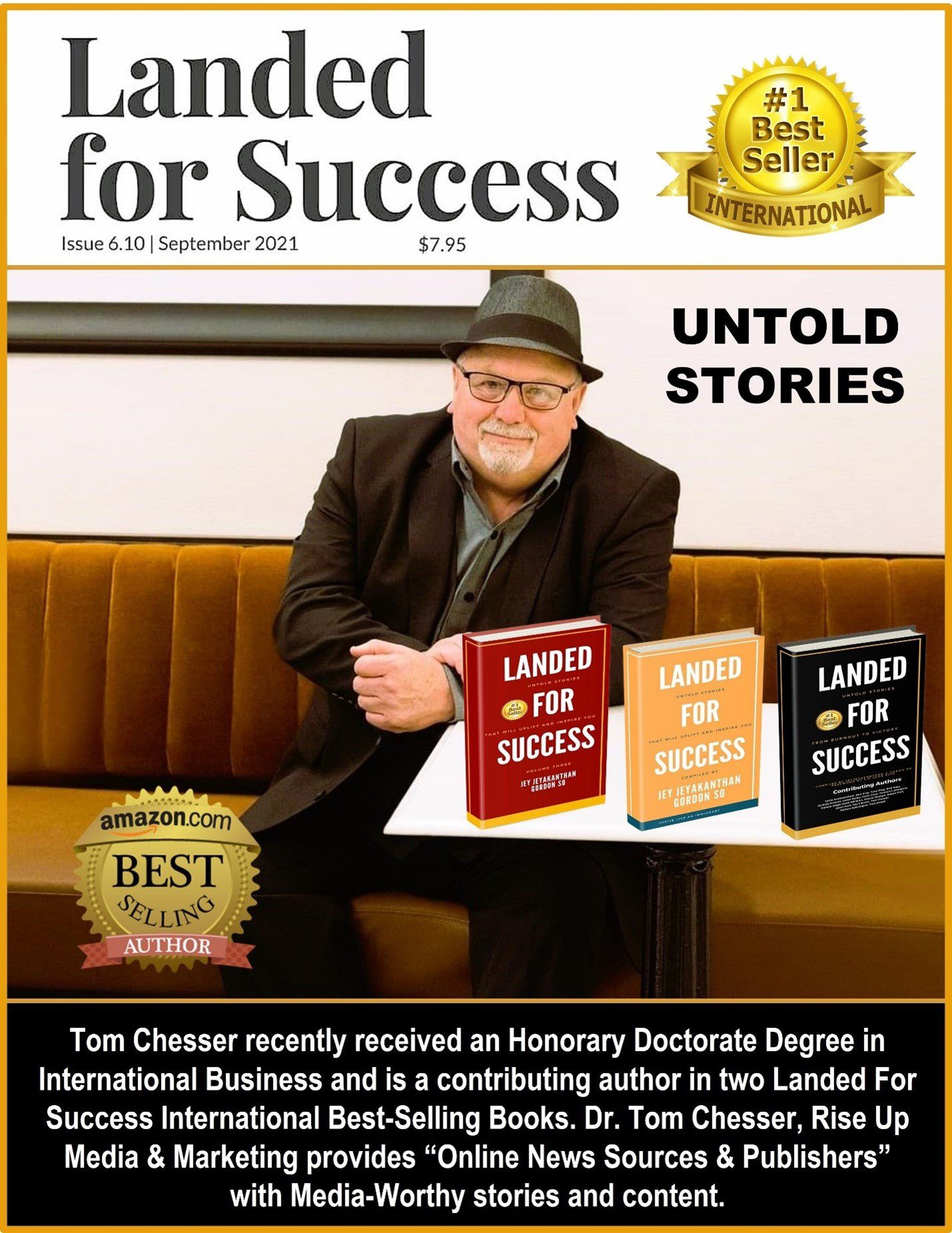

Landed for Success is a collection of stories celebrating the triumphs and resilience of individuals from all walks of life. Founded by Jey Jeyakanthan and Gordon So, the series has gained international recognition; with the first three volumes reaching international bestseller status in multiple countries, including Canada, the United States, Mexico, Europe & Asia, Landed for Success has become a source of motivation and guidance for those seeking their path to Success. They are inspiring readers across the globe.

With the upcoming release of volume four, Landed for Success, Untold Stories, the founders and authors continue to share their experiences and insights, encouraging readers to embark on their journey to Success. These books remind readers that Success knows no boundaries and that anyone can achieve greatness with determination and perseverance.

Dr. Tom Chesser’s Insightful Contributions:

One of the authors featured in the Landed for Success series is Dr. Tom Chesser, who shares brilliant stories; in the Landed For Success Book titled “Going From Burnout To Victory,” Chapter 16: Finding The Superhero In You – Dr. Tom Chesser wrote, “We all have a time in our lives when things have happened that we did not ask for or expect. It is not what happens to you in life; how you react to what happens to you that counts the most. I genuinely believe there is a superhero in each of us with superpowers that no one else has. We all face a time of Burnout. Only when we realize that our lives matter and our story can we make a difference; then, we can see our actual God-given superpowers. Yes, people will face adversity, and villains will try to steal your superpowers. Some might be your friends, family members, or business relationships. However, you never know when all that could turn around and become a blessing in disguise. So, let’s find the Superhero in you and work together to save the World!”

Dr. Chesser understands that Burnout is real and that everyone’s mental wellness is being challenged daily. Chesser hopes people come along this journey with the 19 authors from Volume Two, “Landed for Success, Untold Stories, From Burnout to Victory.” They look forward to hearing about other people’s victories and how they have Landed for Success.

In the third edition, Landed For Success Untold Stories, Dr. Chesser shared “Lessons Learned From the Inside The Cockpit Of An Airplane.” Dr. Chesser’s story offers a unique perspective on Success, drawing parallels between the cockpit of an airplane and the challenges individuals face in their personal and professional lives. If an individual could ever climb into the cockpit of an airplane, they would see many gauges and instruments. One of these instruments is known as the “Attitude Indicator.” Its purpose is to let the pilot see the aircraft’s orientation and position to the earth’s horizon. It indicates whether the plane is level or turning left or right and whether it’s gaining or losing altitude. So basically, the “Attitude Indicator.” of the airplane will determine its performance. Chesser’s emphasis is placed on how a person’s attitude can affect their altitude. Chesser even quotes Zig Ziglar: “It’s your attitude, not your aptitude, that will determine your altitude.”. Chesser believes that a person’s thoughts lead to actions, actions lead to habits, habits lead to character, and character develops a person’s future.

Landed for Success has invited Dr. Chesser to contribute to volume four, titled Landed for Success, Untold Stories, which promises to be another insightful addition to the collection. Dr. Chesser’s mission is to inspire others to participate in the Landed for Success stories.

The primary goal of Landed for Success is to inspire readers to embark on their journey to Success. Each story shared in the series serves as a source of motivation, offering valuable insights & lessons that can be applied to all aspects of life. By showcasing the experiences of immigrants and individuals from diverse backgrounds, the books emphasize the universal nature of Success and the potential for achievement regardless of one’s starting point.

The Success of the Landed for Success series is evident through its international recognition. The first three volumes have achieved #1 International Bestseller status in Canada, the United States, and Mexico and International Bestseller status in numerous other countries worldwide. This global recognition highlights the universal appeal of the stories shared within the books, resonating with readers from different cultures and backgrounds.

The books are available for purchase on Amazon to make these inspiring stories accessible to a broader audience. Readers can easily find volumes one, two, and three of Landed for Success, with volume four, Landed for Success, Untold Stories, soon to be released. By making the books readily available, the founders aim to reach as many individuals as possible, providing them with the inspiration and guidance to pursue their path to Success.

Dr. Tom Chesser, from Rise Up Media & Marketing, teaches people how to leverage PR, Media, and Marketing to grow a business.

To learn about Landed for Success, visit https://www.landedforsuccess.com

To connect with Dr. Tom Chesser, call 210-289-5996 or email him at riseupmediamarketing@gmail.com

News3 days ago

News3 days ago

News5 days ago

News5 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago