Finance & Accounting

What is Cost of Goods Sold? (COGS)

Published

2 years agoon

Get up to 30%* off! Get going with GoDaddy!

This content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation.

This article was originally published on Feb. 22, 2016, and was updated on Jan. 20, 2022.

Table of contents:

Managing cash flow is critical to the ongoing health of your small business. Unfortunately, many entrepreneurs struggle to do so effectively.

Lending Tree reports that almost 30% of small businesses blame “running out of cash” as a major contributor to their startup failure. Almost 20% say they went under due to pricing or cost issues.

Calculating and understanding your cost of goods sold (COGS) will help you to better understand your small business cash flow, and set you up for long-term success.

In this post, we’ll explain what the cost of goods sold is, how to calculate it, and how to report it during tax season.

What is cost of goods sold (COGS)?

Your cost of goods sold includes the direct costs associated with the production of the products your small business sells.

Your direct costs are most often the inventory purchased to make or sell products to customers. But there are other purchased items and indirect costs (like overhead costs) that can be included in your COGS calculations, which we’ll get into shortly.

What counts under COGS?

If you own a donut franchise, for example, you’d include the following in your COGS calculation:

- The direct inventory cost of manufacturing the donuts, including the regular purchase of baking soda, flour, sugar, and yeast.

- Any tools you need to operate while making a donut — from pots and pans to fryers and stand mixers.

- Indirect costs like employee wages to make the donuts, utility bills for things like water (if it’s in the recipe), or rent paid for a manufacturing facility.

What’s not included in COGS

If you are a small business owner who doesn’t manufacture your own products, your cost of goods sold typically would not factor in your indirect overhead costs (or operating expenses) incurred to run your business.

For example, when you purchase inventory from other vendors for resale, your indirect costs might include the monthly cost to rent your storefront or to keep the lights on.

Likewise, you do not need to include anything in your COGS calculations that goes into your cost of revenue, meaning the total amount you invest to sell products to customers. These costs include line items like your marketing and product distribution expenditures.

It’s always best to check with an accountant or tax expert to learn what direct and indirect costs should or shouldn’t be included in your COGS calculation.

Why service-based small businesses don’t use COGS

When doing COGS calculations, business owners must itemize the inventory they purchased (within a set time period) to manufacture or sell their products to customers.

That’s why most service-based businesses, like freelancers, consultants, and service-based software do not typically use COGS when preparing financial statements.

Of course, there are some exceptions, like a hairdresser who might sell items in-store such as shampoo, hairstyling products, and anything else that is part of their inventory as a good to be sold.

Why small businesses should care about COGS

From a tax perspective, you need to know your cost of goods sold — broken down into different line items on your business income tax form — so you can report it to the government. We’ll get into income tax reporting for COGS later in this post.

From an accounting and finance perspective, small business owners must also understand your break-even point and determine the lowest price you can set for your products to keep your business running smoothly.

COGS plays a crucial role in determining those factors, as well as in managing cash flow and finding cost savings.

For help with calculating your break-even point, read: “What is break-even analysis.” You might also want to learn more about cash flow forecasting for small businesses, and understand how to avoid cash flow problems.

How to calculate cost of goods sold

To calculate your cost of goods sold, you first need to understand the total amount of inventory and other relevant costs (if you’re a manufacturer) you regularly spend for the products you sell on a monthly, quarterly, and annual basis.

The time period for calculating COGS depends on the type of business you run and how you do your accounting.

Likewise, there are different ways to do the COGS calculations, including:

- First in, first out (FIFO)

- Last in, first out (LIFO)

- Average cost

- Special ID method

It’s crucial to have all of this information ready for your accountant — or for a tax professional to help you understand what you need to do if you manage your own books.

COGS calculation formula

For each relevant COGS reporting time period, start with the total value of your beginning inventory (i.e. the materials you already have on-hand) before you make any new purchases. Then, add on the total value of any new materials you purchased over the same time period.

For simplicity, let’s say you want to measure COGS over one month, and your total value for existing inventory is 5,000 units at a cost of $1.00 each. Your beginning inventory is, therefore, worth $5,000.

Next, you buy an additional 5,000 units at the same cost. You now have $10,000 worth of inventory ($5,000 + $5,000) to sell.

Over the course of that month, you sell 7,500 units. At the end of the month, you’re now left with 2,500 units in your inventory (at a cost of $1.00 each = $2,500).

Here’s the formula you’d use to calculate your cost of goods sold for the month:

Beginning inventory = $5,000

- Purchases = $5,000

– Ending inventory = $2,500

________________________

Cost of goods sold = $7,500 for one month

As your business grows, and as you start to measure your cost of goods sold over longer periods, you might use more sophisticated ways to calculate these numbers.

Let’s assume you’re looking at your COGS on a quarterly basis, and the cost to purchase your inventory changes each month. The first month, the cost per unit is $1.00, the second month it goes up to $1.50, and in the third month, it costs $1.25 per unit.

First in, First Out (FIFO) method

This COGS accounting method assumes you’ll sell the inventory worth $1.00 per unit first, before selling items sold in later months. Let’s assume that over the 2nd quarter of 2022, you sell a total of 325 units. In April, you had 100 units left in stock (worth $1.00 each) and you sold all of them.

In May, you purchased an additional 200 units at $1.50 each and sold all of them. Finally, you purchased another 200 in June and sold only 25.

Let’s do the COGS calculation, starting with the cost per unit sold each month.

- April = $1.00 x 100 units = $100

- May = $1.50 x 200 units = $300

- June = $2.00 x 200 units = $400

Your cost per goods sold is, therefore:

$100 (for the existing inventory in April)

+ Purchases in May and June worth $700 ($300 + $400)

– Ending inventory of 175 units (@ $2.00 each) = $350

________________________________

$450 is your quarterly FIFO COGS ($100 + $700 – $350)

Last in, Last Out (LIFO) method

In this scenario, you calculate COGS by using the value of your inventory in the last month of the quarter first.

Some businesses use this method to get a tax break when their cost per unit goes up significantly over a set time period.

Using the numbers illustrated above in the FIFO COGS calculation, you’d use the value of your goods purchased in June as your starting point. Let’s say you sold a total of 300 units in the quarter. You’d take the value of the 200 units sold in June (at $400), add 100 units at the May rate (100 x $1.50 = $150), and calculate your COGS like this:

$400 (for all units bought in June)

+ $400 (for units purchased in April and May)

– $250 (inventory left from April and May = 100 @ $1.50 + 100 @ $1.00)

____________________

$550 is your quarterly LIFO COGS ($400 + $400 – $250)

Keep in mind that using the LIFO method for COGS will eat into your profits. Therefore, you need to weigh the value of reporting losses for tax breaks versus reporting higher revenue, which might raise concerns with your bank when you need financing, or if you have any business investors or shareholders (as your business grows).

Average cost method

This is a simple COGS method that uses the average cost of the inventory purchased over a three-month or annual reporting period in the COGS calculation.

Using the example above, you’d add all three unit prices up and apply the average cost against all units sold during that time period. You may want to start out using the average cost method to manage cash flow, especially if you don’t manufacture your own products.

Special ID method

This COGS method is used when you sell multiple products that vary in manufacturing costs over a set time period. For example, an automobile manufacturer will sell different car models with different product identification numbers. In this instance, it would be wise to work with an accountant to properly calculate your COGS.

What do I need to know about COGS and taxes?

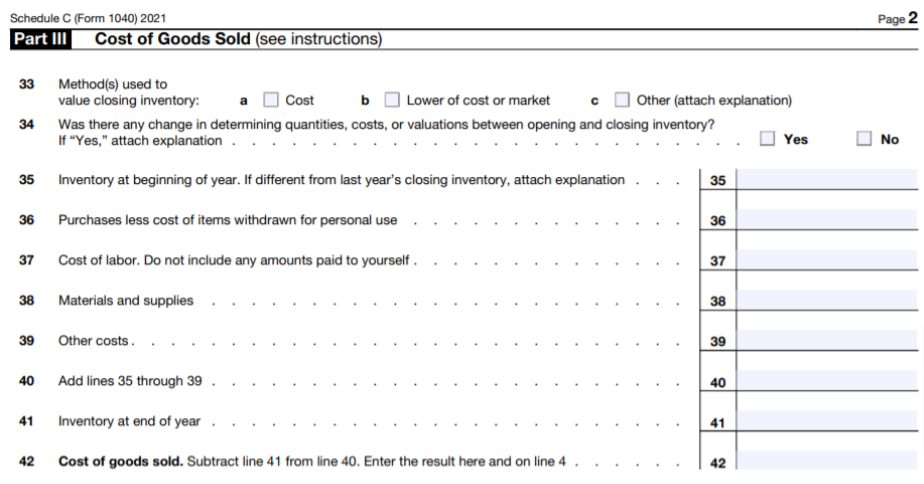

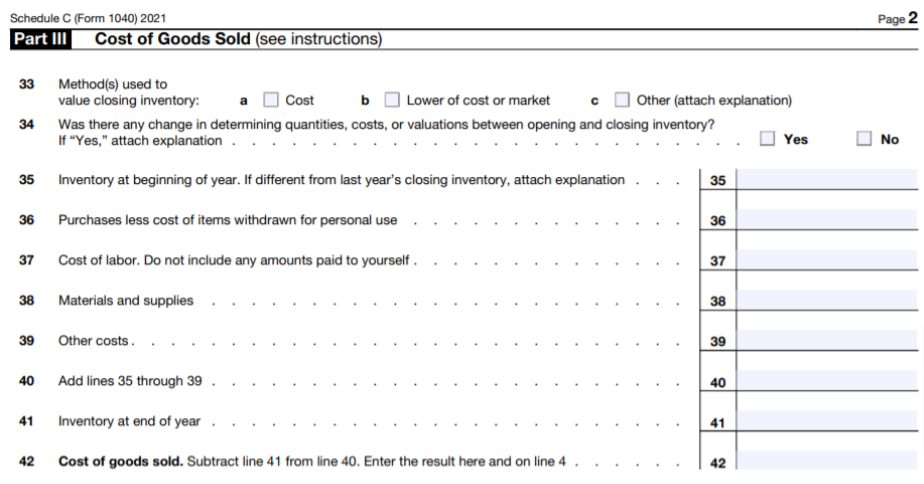

Regardless of whether you calculate your COGS monthly or quarterly, you’ll need to do so during tax season. Your COGS calculations must be completed in Part III (Schedule C) of your small business income tax statement.

You can use the cost of goods sold worksheet on lines 35 to 42 of page two.

This content should not be construed as legal or tax advice. Always consult an attorney or tax professional regarding your specific legal or tax situation. Check the IRS website for up-to-date instructions and requirements.

Let’s take a closer look at each of the line items that go into the COGS calculation.

Line 35: Inventory at the beginning of the year

If you’re an online or physical retailer, and simply re-sell the inventory you purchase from someone else, the amount on this line is the cost of the merchandise you had on hand at the beginning of the year.

It’s different if you manufacture your own products. The amount on this line would be the cost of any items you produced, plus the cost of the supplies you purchased in the reporting tax year and still have on hand to make products you’ll sell in the future.

Note: If there is any difference between the previous year’s ending inventory and this year’s beginning inventory, you will need to explain why.

Line 36: Purchases less cost of items withdrawn for personal use

For re-sellers, the amount you input on this line should be the inventory you bought during the tax year.

If you manufacture your own items to sell, the amount should include the materials and parts you purchased during the year from vendors (including any discounts they gave you).

Always be sure to remove the cost of any items you returned, as well as any items you pulled out of your inventory for your own personal use.

Line 37: Cost of labor (minus your own paid labor)

Your cost of labor consists of three elements:

- Direct labor: Wages you paid to employees who made the products to be sold.

- Indirect labor: What you paid to employees who performed general factory functions, such as a foreman, and whose work does not have a direct connection with the making of the product.

- Other labor: Wages for selling or administrative personnel.

If you run a manufacturing business, the labor costs you input on line 37 for COGS should be relevant to each product produced during the period. A tax account should be able to help you identify which costs to use in your COGS calculation.

Re-sellers won’t likely have many labor costs, and you must not include your own paid labor (as the business owner) in your cost of goods sold.

Line 38: Materials and supplies

The number inputted on this line for COGS should include the cost of the items that are separate from the main materials used in the manufacturing of your product — but are still an important part of producing it.

For example, these materials might include glue or buttons that a fashion retailer sews onto their garments.

Line 39: Other costs

Additional costs can be added to your cost of goods sold, depending on the type of business your run.

Manufacturers can use this line to record any additional costs of creating your product — such as packaging and shipping costs to bring in supplies and materials — as well as the overhead costs for running your factory (but not the costs to sell or distribute products).

Line 40: Cost of goods available for sale

On this line, you should add up the amounts on lines 35 through 39 to get the total cost of goods available for sale.

Line 41: Inventory at end of the year

On this line, you should include the value of the items you have in your inventory that have not yet been sold as of year-end.

Like most businesses, you may need to do a physical inventory count of what you have in stock on December 31, and determine the cost to produce the items in that count.

When placing a value on your end-of-year inventory, be sure to use the cost to produce the items in your COGS calculation and not the price you charged customers for these items.

Now you have everything you need to calculate your cost of goods sold for the tax year. On line 42, subtract the amount on line 41 from line 40. You’ll input this final number on line 4 of page 1 of Schedule C – Cost of Goods Sold.

For additional help when completing your small business taxes, read: How to organize your financial statements to make tax season smooth sailing.

Planning for long-term growth with COGS

Once you calculate your cost of goods sold, you’ll gain a better understanding of your monthly, quarterly, and annual cash flow.

Your COGS calculations can also help you to price your products accordingly, complete your business income taxes, and plan for the long-term growth and success of your small business.

Keep in mind, the above content provides a general explanation, and how you calculate COGS will depend on many factors. For example, manufacturing businesses will have more sophisticated requirements for tracking inventory and calculating the cost of goods sold.

Always consult an accountant or tax professional for specific COGS reporting or tax requirements for your small business.

This article includes content originally published on the GoDaddy Blog by Chris Peden.

Finance & Accounting

Small Business Funding: Exploring Options and Strategies

Published

7 months agoon

July 3, 2023Small businesses recognize the key role of funding in propelling their growth, as every dollar invested paves the way for opportunities and prosperity. That said, securing funding is often a critical step for small businesses to start, expand, or sustain their operations.

While funding options may vary depending on the business’s stage and needs, it’s essential for small business owners to explore the available options and develop effective funding strategies. Read on to explore various funding options and strategies that can help small businesses obtain the necessary capital for success.

1. Self-Funding and Bootstrapping

Self-funding, also known as bootstrapping, involves using personal savings or assets to finance your small business. This option allows you to retain full control over your business and avoid debt. However, it may limit the initial capital available and may require personal financial sacrifices to invest in your business’s growth.

2. Friends and Family

Seeking financial support from friends and family members is a common option for small business owners. It involves borrowing money or receiving investments from people you have personal relationships with. While this option may offer flexibility and lenient terms, it’s essential to approach such arrangements professionally and have clear agreements in place to avoid potential conflicts.

3. Small Business Loans

Small business loans are a traditional funding option offered by banks, credit unions, and other financial institutions. These loans provide capital with a defined repayment schedule and interest rate. Small business owners need to present a solid business plan, financial records, and collateral to qualify for a loan.

It’s crucial to carefully review terms and interest rates to ensure the loan is manageable for your business.

4. Crowdfunding

Crowdfunding platforms allow businesses to raise funds from a large number of individuals who contribute varying amounts. This option leverages the power of the crowd and can provide not only financial support but also help validate your business idea and build a community around your brand.

Effective crowdfunding campaigns require compelling pitches, engaging rewards, and strong marketing efforts to attract backers.

5. Grants and Government Programs

Various grants and government programs are available to support small businesses in specific industries or locations. These funding options often have specific eligibility criteria and application processes. Research local, regional, and national grant programs relevant to your business’s industry or specific needs.

Applying for grants may require significant effort, but it can provide non-repayable funds to support your business’s growth.

6. Angel Investors and Venture Capital

Angel investors and venture capital firms are sources of funding for small businesses with high growth potential. Angel investors are individuals who provide capital in exchange for equity or ownership in the company. Venture capital firms, on the other hand, invest larger amounts of capital in exchange for equity stakes.

These funding options often come with expertise and mentorship from experienced investors, but they also involve giving up partial ownership and decision-making control.

7. Business Incubators and Accelerators

Business incubators and accelerators are programs designed to support early-stage startups by providing funding, mentorship, and resources. These programs often require entrepreneurs to go through a competitive application process. In addition to financial support, incubators and accelerators offer guidance, networking opportunities, and access to a supportive community of fellow entrepreneurs.

8. Alternative Financing Options

In addition to traditional funding methods, small businesses can explore alternative financing options. These may include invoice financing, where you sell your outstanding invoices to a third party for immediate cash, or merchant cash advances, where you receive a lump sum in exchange for a portion of future sales.

While these options can provide quick access to capital, it’s important to carefully assess the terms and potential impact on your cash flow.

9. Business Credit Cards

Business credit cards can be a convenient and flexible funding option for small businesses. They allow you to access a revolving line of credit that you can use for various expenses.

It’s important to choose a credit card with favorable terms, such as low interest rates and rewards programs that align with your business needs. However, it’s crucial to use business credit cards responsibly and avoid accumulating excessive debt.

Takeaway

Exploring funding options and developing effective strategies is essential for small businesses to secure the necessary capital for success. Whether through self-funding, seeking support from friends and family, obtaining small business loans, utilizing crowdfunding, accessing grants and government programs, seeking angel investors or venture capital, participating in business incubators and accelerators, or exploring alternative financing options and business credit cards, small business owners have a range of options to consider.

You need to carefully evaluate each option, consider the associated terms and risks, and choose the funding approach that best supports your business’s growth and long-term financial stability.

Starting a business can be costly. Whether it is for a start-up business or a new and exciting idea in your business, a loan is an example of a funding option. The choice of funding can determine the structure of the business, and therefore, it is essential to make the right choice.

Why Use a Comparison Site?

There are different types of funding. Self-funding and investors are two types of funding, the last being loans. If a loan is the right choice, it is important to compare different options to find one that best fits your business.

You can compare loans on creddio.com with factors like interest rates and repayment options is the way to secure the most stable and suitable loan. Otherwise, you may end up with a loan that can be difficult to repay. The comparison site gathers all the necessary information such as fees, loan terms and even special features like whether or not the loan comes with a discount.

Eligibility for a Business Loan

If you are starting up a business, the bank may not be willing to finance your loan. As such, the eligibility for a loan often depends on the financial situation of your business. This can include your credit history and income. But certain requirements depend on who is providing the loan.

For example, the U.S. government requires a business to be registered, and that the business is located within the country. Generally, taking a loan out depends on the state of your finances. Therefore, it is a good idea to understand your business’s financial situation before applying for a loan.

Loan for Your Business

When considering a loan, one of the first things to discover is what you need the funding for. Is it to start up a business? Is it to hire more people? Or do you need more capital for a big project? The amount of money you can secure in a loan will depend on your loan proposal.

When applying for a loan, you need to state things like personal finances and how long the business has been running. After that, the financial institution will get in contact, and you will be able to see their loan offer.

Types of Loans

When loaning money for a business, there are two types of loans: Secured and unsecured business loans. A secured loan is a loan where you as the borrower give an asset to secure the loan. This can be anything from your car to your home. The lender then has a claim over the asset, the personal possession, until the loan is repaid.

An unsecured business loan does not require an asset and includes loans like quick loans, personal loans and credit cards. However, the interest rates are also higher with unsecured loans.

Regardless of which type of loan you plan on receiving, it is paramount that you research all your options and have a good understanding of your business’s financial situation before applying for funding.

Finance & Accounting

How much does it cost to start a business in 2023

Published

10 months agoon

March 27, 2023

Get up to 30%* off! Get going with GoDaddy!

Products mentioned

Starting a business in 2023 needn’t be overwhelming. I get it, there’s a lot to think about and as a new entrepreneur, there’s one thing on your mind: money. Can you afford it, will the business sustain you, how will you juggle your side hustle alongside your life commitments – maybe even another full-time job – exactly how much does it cost to start a business in 2023?

No doubt, there’s a lot to think about, but the more you think the more reasons you’ll find not to follow your dreams and that’s the last thing I want for you.

So, instead of overthinking, read through this comprehensive guide including a breakdown of startup costs and tips to manage costs at every step.

Fixed costs to start a business in 2023

The fixed costs of your startup will depend on the type of business. As a freelancer you can start up a business for $0, assuming you already own a PC and have access to Wi-Fi.

Businesses that need more involvement from operations, products or digital assets like websites may need to spend more.

The cost of your business will be unique, but you can use the guides below to determine how much it costs to start your dream business in 2023.

Domain, website or online store

The majority of startups need a website either to trade and receive enquiries online or for a presence in Google search and Google maps for local search.

That said, if you’re starting a service-based business you may be able to drum up business without a website by using social media platforms like LinkedIn. This is what I did for two years, keeping my start-up cost at $0.

To save the cost of a website, ecommerce stores can create shops on Etsy and pay minimal fees to upload products. Then, it’s just a commission on sales. Alternatively, you can start affiliate marketing on TikTok which costs nothing to set up.

While free alternatives are great, at some point your business will likely grow to a point where you want a more robust online presence. And ecommerce merchants should be prepared to source a point-of-sale (POS) system or technology allowing them to accept online payments.

For entrepreneurs who need a website, start by sourcing your domain and hosting.

In general, non-premium domains cost between $1 to $20, depending on the deal you are getting and the number of years you decide to register the domain for. To explore prices buy a domain and search for your desired website URL.

Tips for managing the cost of domains: you can cut costs by exploring cheaper domain suffixes. Generally, but not always, .com or .co.uk will be more expensive than .co, .io, .site, .shop. There are a lot of domain options so spend some time exploring suffixes and pricing.

Your website host is required to get your site on the internet and in front of customers. You’ll need to web hosting.

Tips for managing the cost of hosting: pay annually or for many years in advance to save money.

Website design and development

For those who need to create a website you can use drag-and-drop editors. This is perfect if you really want to cut costs. You can build brochure websites or use the online store builder if you’re starting with ecommerce.

If you’re not willing to create the website yourself, then don’t fret because there are affordable website design services to guarantee a website you (and your customers) will love. I’ve known entrepreneurs who started with websites that are quite affordable.

Tips for managing the cost of website design and build: if the thought of designing and developing a website is overwhelming, but you want to save costs, commit a couple of hours to creating a website with GoDaddy. I promise it’s easy and you might surprise yourself.

While you’re creating a website, consider creating a logo to display on your web pages and other brand collateral. Services like GoDaddy Logo Maker are free and let you quickly snag this key piece of branding.

Legal costs to register a business

Legal costs vary hugely between types of business and the required legal cover. If you’ve figured out how to create an LLC and you’re ready for the costs associated you can expect to pay anything from $485 to more than $1,000. Of course, this depends on what you can do yourself. More savvy start-ups may be able to tackle some of the legal requirements, thus saving money.

Tips for managing legal costs: consider the essentials. As a new business owner, it can be tempting to cover your business from every angle, but this may not be required at the very beginning. Consider what’s a must-have to start up, then take note of what you can purchase later and when it’s needed.

Marketing

Marketing is one of the most flexible costs when starting a business. The options are endless.

At the cheapest, GoDaddy can support your business from $85/month, but a more multi-channelled approach will cost $500/month*.

The good thing about marketing is that you can do a lot alone. If you’re happy to manage social media platforms to drum up business, you can do well without spending a penny. It is time-consuming so that time investment must be considered.

If you’re thinking about marketing your business with ads then you need to consider the cost of ads versus the benefit. Generally, it’s not useful to start with a budget that’s too small simply because you won’t get the data you need to decipher a good ads campaign from a bad one. Don’t start an ads campaign until you’re ready to commit.

Tips for managing marketing costs: choose your marketing channels carefully, and do your research to find out which one is likely to have the biggest impact. It’s better to cover fewer channels well than many channels poorly. After all, you can always scale once you’ve nailed one platform.

Variable costs to start a business in 2023

Some prices are incredibly variable depending on location and the needs of the business. These items are listed below.

Physical location

The beauty of starting a business in 2023 is that many businesses won’t need a physical location, but if you’re opening a brick-and-mortar store or plan to work in an office you’ll need to think about rent or mortgages.

Products or inventory

If you need to buy and hold stock you’ll need to outlay an initial investment upfront. The cost will vary on the units required. You can manage these costs by thinking carefully about what you’re likely to sell. Another consideration is what you can sell if you buy stock in bulk.

Tips for managing product and inventory costs: ask suppliers about their minimum order quantity (MOQ) and how costs vary on quantity. Also, consider drop shipping so you don’t have to outlay any costs at all.

Staff

Staff costs depend on seniority and location. You’ll need to consider the minimum wage of your state, but the federal minimum wage is $7.25.

Tips for managing staffing costs: businesses trading online can outsource work to talented new freelancers or over-pay freelancers in different parts of the world. You can also take on more work yourself or turn to software and AI to support your business.

Taxes

Beyond the initial registration, startups need to consider tax. The rules surrounding tax vary so you must check the rules within the country in which your business is registered.

Paying your taxes usually means putting a percentage of your income aside to cover the costs, monitoring and recording your expenses to account correctly for tax write-offs or hiring an accountant to manage taxes for you.

Tips for managing tax costs: the more self-efficient you are, the less you need to pay an accountant. Many small businesses can manage the early tax returns alone, but a growing business will likely need an accountant eventually. Manage the costs by putting money aside regularly.

On-going expenses

As a small business you’re likely to have ongoing expenses. You may not start with them but over time you’ll likely invest in subscriptions or software. Or, you might have shipping to consider for e-commerce. Costs will vary based on your requirements.

Tips for managing ongoing expenses: on-going expenses can creep up on business owners so be mindful of monthly subscriptions and the well-intentioned software you purchased. If you’re not using it, you’re throwing away money.

Unexpected costs

No matter what, any business is likely to be hit with an unexpected cost, eventually. Prepare for the unexpected by holding a budget to get you out of an emergency situation. Unexpected costs could include your sickness, the need to hire a consultant to solve a problem fast or if you’re in a brick-and-mortar store something could go wrong within the building.

How to fund your startup or small business

Getting funding for your new business is likely on your mind. Here are some common ways to earn funding for your start up.

Personal investment

Funding your business on your own can be a safe option. It removes the stress of meeting investor expectations and it can feel really good to know you build your new business with your own means.

Personal investment may require you to save for a few years before you get started, but freedom from other stakeholders can be highly desirable in the early stages.

Borrowing money through contacts

You can opt to borrow money from your personal contacts, friends and family, for example. If you choose to go down this route it’s really important to treat it as you would as a formal investment: draw up contracts, separate personal and businesses conversations. Be very clear on what the contract is.

Loans

Securing loans from banks is an option for funding. Generally, banks provide calculators on their websites so you can gage what you might be able to borrow. Be aware that it isn’t easy to get accepted for a bank loan, 80 – 90% of startups fail so banks are naturally careful who they lend money to.

Create a budget for your first year

Let’s take a look at various cost summaries for businesses with varying needs.

Freelance business

Your freelance service-based business cost summary is one of the cheapest businesses to start, it might look a bit like this:

| Expense | Cost | Notes |

|---|---|---|

| Laptop | $0 | freelancers can start with any laptop that they have access to. |

| Internet | $0 | work from home and freelancers don’t need to worry about additional costs for wi-fi. |

| Social media | $0 | Organic posts don’t cost anything and can generate leads and clients. |

| Total: | $0 |

Service-based business

For those starting a service-based business and desire a more professional appeal can kick off a new business venture with a functioning site.

Here’s what the cost summary can look like:

| Expense | Cost | Notes |

|---|---|---|

| Domain | $1.67* | Use suffixes like .site to reach that $1.67 cost |

| Create a website | $0 | Get creative and build your own site with GoDaddy. |

| Website design services | $350 and up | Optionally: chose website design services. |

| Web hosting | From $215.64/3 years* | Host your website for 3 years to pay less per annum. |

Marketing costs for the first year

If you choose to work with a service provider like GoDaddy your digital marketing services can be covered for as low as $85.00/month.

| SEO and website updates | From $85.00/month |

| SEO, website updates and social media | From $185.00/month (+$50 ad spend) |

| SEO, website updates and social media, content, emails reputation management, brand guides and a professional photo shoot | From $500.00/month (+$50 ad spend) |

| Minimal total: | $85.00/month* |

Businesses you can start with a small budget

The digital world has opened a world of opportunity when it comes to starting a business for free or with a small budget.

Assuming you’ve got a PC, wi-fi and a desire to work or use social media to generate leads, you can start any of the following small business ideas, for free:

- Freelancing in digital services like writing, SEO, PPC, social media management or email marketing.

- Freelancing on platforms like Upwork or Fiverr.

- Affiliate marketing through social media platforms like TikTok. You will need to gain 1,000 followers before you can start this one.

- Consulting in a skill you already have (or can learn for free online).

Local services you can start with little to no start-up costs:

- Dog walking

- Babysitting

- Homesitting

- Handyman

- Tutoring

Some businesses require a small budget to start, for example:

- Selling digital downloads on Etsy. You’ll pay a small fee to upload products, but then nothing until you make your first sale where you pay a percentage to Etsy.

- Dropshipping

- Selling on eBay.

- Print (assuming you’re doing the printing)

Closing thoughts on starting a business in 2023

Today, there is a lot of technology out there that can boost the success of your business. While there might be expenses associated with it, don’t forget the financial rewards that come with a successful venture. Keep that momentum going and make 2023 the year you founded a business to be proud of.

*Pricing data valid on March 2023. All prices listed are subject to change.

Landed For Success Showcases Inspiring Stories By Dr. Tom Chesser Achieving #1 International Bestseller Status In Canada, United States, Mexico, Europe & Asia

Bob Chitrathorn Renews Membership with the Financial Services Institute

Ryan Quante, Founder of Care Income Advisors, Interviewed on the Influential Entrepreneurs Podcast Discussing Dementia Care

Hiring a Remote Worker? It Takes More Than an Internet Connection

Flexible, shorter-term apartment startups gain more traction

Six Office Remodels That Will Help Improve Work Culture

Trending

-

News4 days ago

News4 days agoRyan Quante, Founder of Care Income Advisors, Interviewed on the Influential Entrepreneurs Podcast Discussing Dementia Care

-

News6 days ago

News6 days agoSensationally Wired Launches the NeuroSoothed Sleep Method Course, Offering Transformative Techniques for Improved Sleep

-

News3 days ago

News3 days agoBob Chitrathorn Renews Membership with the Financial Services Institute

-

News3 days ago

News3 days agoLanded For Success Showcases Inspiring Stories By Dr. Tom Chesser Achieving #1 International Bestseller Status In Canada, United States, Mexico, Europe & Asia

-

News4 days ago

News4 days agoJohn Martin with Compass Wealth Strategies Interviewed on the Influential Entrepreneurs Podcast Discussing Using Life Insurance for Retirement

-

News4 days ago

News4 days agoDOSS Celebrates Significant Milestone: First DOSS Home Center Franchise Opens in Flower Mound, Texas

-

News4 days ago

News4 days agoDr. Annette Greenwood Empowers Women Over 50 to Triumph Over Adversity and Rediscover Life’s Magic