From car insurance to cell phone bills and mortgage repayments to utility bills, the average homeowner probably has more monthly outgoings than they’d like. Since many of the creditors, we make recurring monthly payments to share our payment information with Equifax, Experian, and TransUnion, meaning that failing to meet your monthly bill payments can negatively affect your credit score. Therefore, it’s more crucial than ever to meet your monthly bill payments and take control of your financial life.

Knowing when your bills are scheduled and getting into a habit of paying them before the day their due can offer you many other benefits besides financial freedom, such as saving money, reducing stress levels, improving your credit score, and helping you secure lower interest credit when you come to apply. But how do you get into a routine of paying off your monthly bills on time? From using a monthly bill tracker to adding your payments to a calendar, we’ve listed some of our top tips for managing your monthly bill payments – keep reading to find out more.

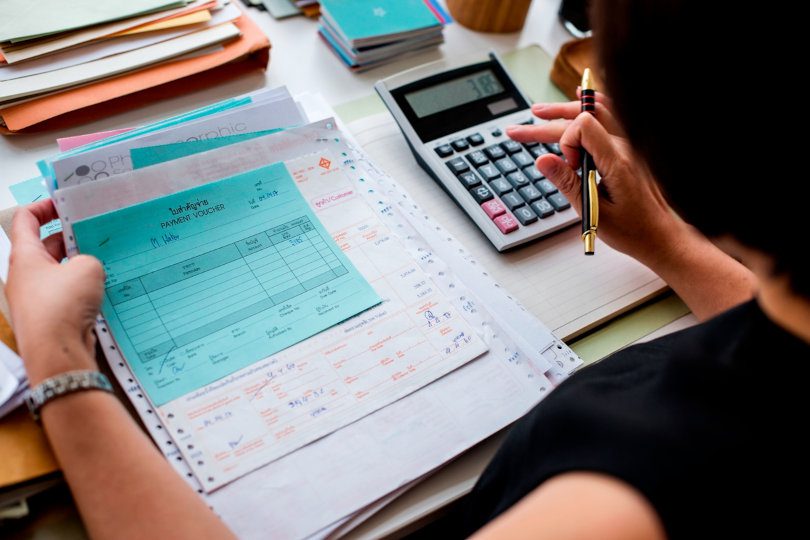

Use A Monthly Bill Tracker

Another way to better manage your monthly bill payments is using a monthly bill tracker. Fortunately, in our technology-driven world, there are a variety of monthly bill trackers for individuals to choose from. Some trackers are manual, whereas others are technology-based and include digital tools or import data to calculate upcoming bills automatically.

Some of the most popular monthly bill trackers are electronic/physical calendars, budget worksheets, spreadsheets, bill-tracking apps, or simple means like a pen and paper. Regardless of which option you choose, using a monthly bill tracker is helpful for tracking which of your bills are due, how much they are, and the dates they are expected to come out.

Using these means can help ensure that you never incur a penalty for a missed bill payment, and since there are so many bill tracking options, we’re sure that you’ll be able to find a method that works for you. If you consider yourself the type of person who finds bill tracking challenging, consider using mobile applications like Tally, which can help manage your monthly credit card bills.

As well as helping you manage your finances in one place, Tally’s application will even automate your payments so that they are paid before their due date. Consider visiting their website for more information, or follow their blog to discover a monthly bill tracker that works for you.

Make A List Of All Your Bills

Let’s face it; we can all attest that we have more monthly outgoings than we’d prefer. We’d wager that some homeowners have so many outgoings that it’s almost impossible to commit them all to memory. Not knowing your financial obligations can make it challenging to pay your bills on time – so start managing them by making a list of all your outgoings.

When you have several bills to pay each month, it can be easy for some of them to disappear under the radar. To prevent this, put some time aside to review your credit reports and your credit/debit card statements to compile all your creditors, recurring payments, and service providers into one list.

As you make your list, include the name of the creditor or service provider, the amount, and the date the payment is due to be completed. Once satisfied with your list, you could separate them into two columns: those that can be automated and those that cannot. Doing so will make it much more straightforward to manage your finances and see which payments are approaching.

Automate Monthly Payments

Once you’ve made a list of all your monthly outgoings and found a monthly bill tracker that works for you, we recommend automating all your bills that can be automated. Depending on the creditor’s terms and conditions, when you set up automated payments, you should be able to decide whether you want to make the payment in full, the minimum, or a specified amount.

As well as making it easier to remember which bills are coming out on which date, automating accounts can also save you the money you would have spent ordering paper checks or money orders from your bank. They can also help prevent you from incurring any penalties if you forget to pay a bill or don’t have enough funds in your account to pay in full.

Determine How Much You Want To Pay

Depending on your lender, creditor, or service provider, you may have to pay a fixed monthly amount. Others – like credit cards – enable you to spend as much or as little as you want after you make the minimum payment.

In a perfect world, you’d be able to pay the total amount on all your accounts, even the ones that allow you to decide how much you want to pay per month. Even if you consistently pay your bills in full, this may not be possible every time, so if you are going to set your own amount, ensure that you make a note of the difference.

News4 days ago

News4 days ago

News6 days ago

News6 days ago

News3 days ago

News3 days ago

News3 days ago

News3 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago