Starting A Business

What Is Operating Revenue?

Published

2 years agoon

Revenue is the primary focus of many business owners and with good reason. Getting money flowing into your business is the first step toward success and profitability. In fact, without revenue, you don’t have a business.

Since revenue is so important, it must be easy to understand, right? Isn’t any money coming into the business revenue?

Actually, not all money coming into your business is considered revenue. And the inflow that is revenue takes several different forms. It’s important to understand how each type of revenue impacts your business accounting and financial statements.

When you think about your business’s revenue, you are probably thinking about a very specific type of revenue: operating revenue. Both operating revenue and non-operating revenue have a positive impact on your business’s finances, but they are not created equal—nor are they reported in the same way on your financial statements.

So, what is operating revenue, and how does it differ from non-operating revenue? How can you tell the two types of revenue apart, and why is it important to do so? Let’s start with a brief operating revenue definition and several examples.

Operating revenue definition

Operating revenue comes from your business’s primary income-generating activity or activities. You might already be familiar with operating revenue, but just know it by a simpler name: sales.

When you first start your business, you will probably only have one or two income-generating activities. These activities are usually directly related to the sale of your product or the delivery of your service. As your business grows, though, you will likely develop other income-generating activities in your business. Not all of these income-generating activities produce operating revenue, though.

Let’s clarify what operating revenue is—and what it is not—with a series of examples.

Operating revenue examples

Let’s say a business produces income in three different ways:

-

Sales of merchandise

-

Contributions from donors

-

Providing services to customers

Which of these three income-generating activities represent operating revenue?

It depends on the business. Here are three examples of how these three types of income-generating activities impact three different types of businesses.

Example 1:

A retail business typically will produce operating revenue from the sale of merchandise. However, that same business might occasionally bring in an outside expert to provide a workshop (service) for customers; this is common in craft and home improvement stores. Additionally, whenever the business is considering launching a new product, they might do some crowdfunding (where they solicit contributions from donors).

This retail business has three types of income, but only one—the sale of merchandise—is operating revenue.

Example 2:

A nonprofit organization, on the other hand, often produces its operating revenue through contributions from donors. But they might also sell merchandise (like T-shirts, window decals, and tote bags) to raise awareness for the organization. Sometimes, a nonprofit will even provide a service—like a community fair—at a reduced cost.

Like the retail business, the nonprofit organization has three types of income, but only the contributions from donors are considered operating revenue.

Example 3:

A service-based business—like a preschool—sells services to their customers, and the customers pay for those services through tuition. Like the nonprofit organization, the preschool might also sell merchandise, either to raise awareness or promote community spirit. Once a year, the preschool might do a fundraising campaign to encourage past customers and other members of the community to contribute to the preschool’s capital fund.

In this example, the preschool—like the retail business and the nonprofit organization—has three types of income. But only the tuition from the service provided to their customers is considered operating revenue.

As you can see from these three examples, what is operating revenue for one business might be non-operating revenue for another. To further complicate things, different businesses within the same business type might have different primary income-generating activities. In the example of the retail business, workshops and classes could be offered on a regular basis, and so they would be considered operating revenue.

If you aren’t sure how to classify your various income-generating activities to properly identify your operating revenue, your business accountant or bookkeeper can help.

Operating income vs. revenue

So far, we’ve been very careful to use the word “revenue” when referring to the cash inflow from your primary income-generating activity. The words “income” and “revenue” are often used interchangeably, though. There aren’t any problems with this, as long as you are certain you understand the meaning of the words as they pertain to your financial statements. Let’s take a closer look at operating income vs. revenue.

Typically, “revenue” means operating revenue, or “top-line” revenue (“top line” because it is the first number on your income statement). In other words, revenue is the total amount of money coming into your business from your primary business activity, less any refunds or returns. The financial statements produced by many modern accounting software packages refer to revenue as “total income.”

On the other hand, operating income is your income after subtracting the operating expenses in your business from your gross profit. Your cost of sales—or cost of goods sold (COGS)—is deducted from your revenue (total income) to calculate your gross profit. Operating expenses are the expenses that go into running your business: rent, administrative costs, supplies, etc.

Operating income is like net income—or your bottom line—except operating income doesn’t include interest, taxes, or non-operating income.

The important thing to keep in mind here is that operating income is not the same as operating revenue/top-line income/total income. Operating revenue or total income is the total cash inflow from your primary income-generating activity. Operating income is the income you have after subtracting the costs of doing business. When you are discussing your financial statements with your accountant or bookkeeper, make sure you are clear about the terms he or she is using.

Operating revenue in your financial statements

Operating revenue appears on your income—or profit and loss (P&L)—statement. As mentioned above, it is the top line—or total income—on the income statement. If you issued refunds in your business, they are subtracted from the total sales to arrive at operating revenue (sometimes also called “net sales”).

Why operating revenue is important

Understanding your operating revenue—what it includes and what it doesn’t—allows you to make year-over-year comparisons of your income statement. At a glance, you can assess the health of your business using the metric of revenue.

If operating revenue and non-operating revenue were combined on your profit and loss statement, unusual activity—like the sale of a piece of equipment—could lead you to make an incorrect assessment of your business’s revenue trend. This, in turn, could cause you to make potentially devastating decisions about your business’s direction.

Other types of revenue besides operating revenue

As we stated earlier, not all money coming into your business is considered revenue. And revenue itself can take many forms, not just operating revenue. Here’s a look at some other types of business revenue and non-revenue.

Non-operating revenue

Not all revenue that comes into your business is from your primary business activity. Therefore, not all revenue can be considered operating revenue. Revenue that is not considered operating revenue is instead classified as non-operating revenue. In the examples earlier:

-

Contributions from donors and sales of services were non-operating revenue for the retail business.

-

Sales of merchandise and sales of services were non-operating revenue for the nonprofit organization.

-

Contributions from donors and sales of merchandise were non-operating revenue for the preschool.

There are other types of non-operating revenue that can impact your profit and loss statement:

-

Sale of assets (buildings, vehicles, equipment, etc.)

-

Interest income

-

Investment income

-

Income from the settlement of lawsuits

All these examples of non-operating revenue have two things in common:

-

They are not produced from the primary business activity of the company.

-

They are sporadic and not expected as part of your business’s income on a regular basis.

Non-operating revenue in your financial statements

Non-operating revenue is typically found toward the end of your profit and loss statement, below operating income and above net income/profit (the “bottom line”). This allows you to clearly see your business’s financial position from operating activities, prior to the impact of non-operating revenue.

Non-revenue cash inflows

Not all cash that comes into your business is from operating revenue or non-operating revenue. Investments from shareholders, contributions of cash from owners, and loan proceeds are all examples of non-revenue cash inflows.

You can find all your operating and non-operating expenses on your profit and loss statement. Non-revenue cash inflows, on the other hand, are found on the balance sheet. And the impact all the different cash inflows—operating revenue, non-operating revenue, and non-revenue—has on your business’s cash balances is found on the statement of cash flows.

Operating revenue: The bottom line

Revenue is the lifeblood of your business. Without revenue, you don’t really have a business at all. And although any money coming into your business is a good thing, in order to accurately gauge your business’s health you need to be able to quickly determine your operating revenue.

Operating revenue is what your business makes from its primary income-generating activity. Because all businesses are different, what is operating revenue for your business might be non-operating revenue for the business in the office next to yours.

You can easily find your operating revenue on your profit and loss, or income, statement. It might go by another name like “total income,” but regardless of what it’s called by your accounting software package, it is the top line of your P&L after refunds are deducted.

As your business grows, non-operating revenue will likely impact the cash inflows in your business. It’s important to separate this revenue from your operating revenue in order to maintain a clear understanding of how your business’s primary income-generating activity is performing.

Operating revenue isn’t the only important metric in your business. Gross profit, operating income, and net income all tell you slightly different things about the health of your business. Your accountant or bookkeeper can help you track trends in these metrics, as well as provide guidance on the ones which are most important for you to focus on at your stage of business.

Marketing

How to start selling online, full guide for beginners

Published

8 months agoon

May 30, 2023

Get up to 30%* off! Get going with GoDaddy!

Is selling online over-saturated? No way! It’s still very doable to make money from anywhere with a laptop. You just need to learn how to sell online and have the dedication to make it work.

This guide will give you proven methods to sell products and services online with insights from people making money using digital platforms. Plus, we’re sharing tips for building your own website and the secrets to selling with social media.

How to start selling online

Before jumping in and making your first sale, you need to know what you’re selling and who to. Through market research, you will find the answers.

Do market research

Once you’ve brainstormed the products or services that you’d like to sell online, you’ll need to see if there’s a market for those products. To do this, there are market research tools online that you can use.

Market research involves gathering information about your target market, competitors and industry trends. The goal is to determine whether or not your ideas are likely to make money and, if they are, how you can reach an audience interested in buying from you.

Market research includes:

- Competitor analysis to see what others are doing and what works for them. You need to look at where you fit within the market, what makes you stand out and what you can offer that competitors don’t.

- Analyzing online forums where your audience hangs out to build a picture of who your audience is and what they need so that you can target them better.

- Look for trends to discover products people are looking for now.

Top tip: When it comes to identifying trends, you can use Google Trends, which is a free tool. Search the product or service you’re considering selling and see how interested people are.

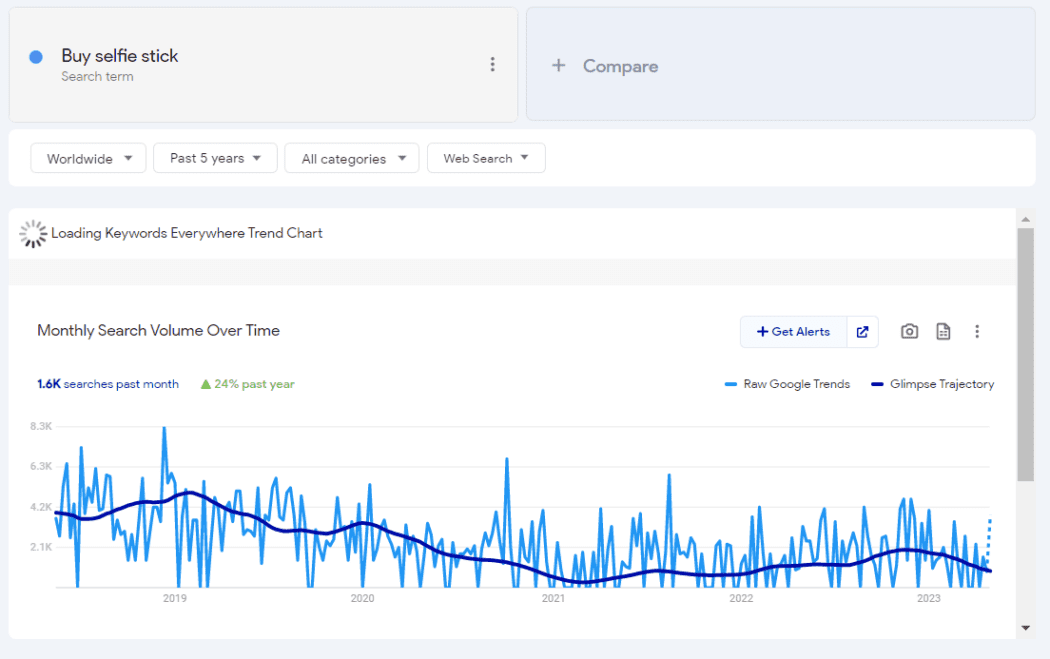

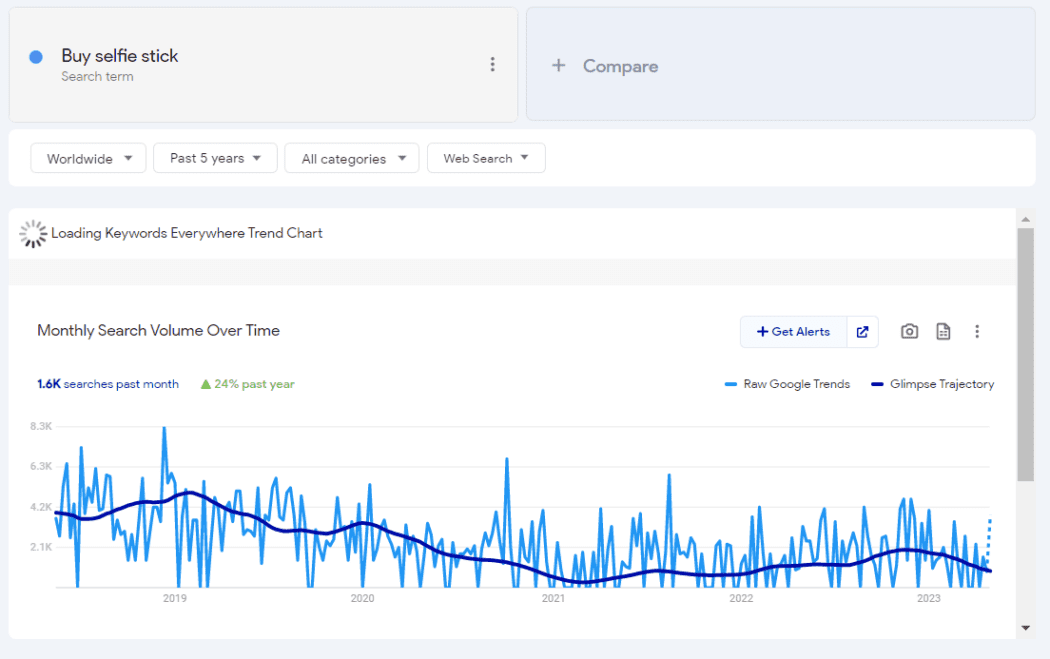

For example, a search for ‘buy selfie stick’ shows that searches for this product peaked in 2018 and have steadily declined in search volume; probably not the product for you right now.

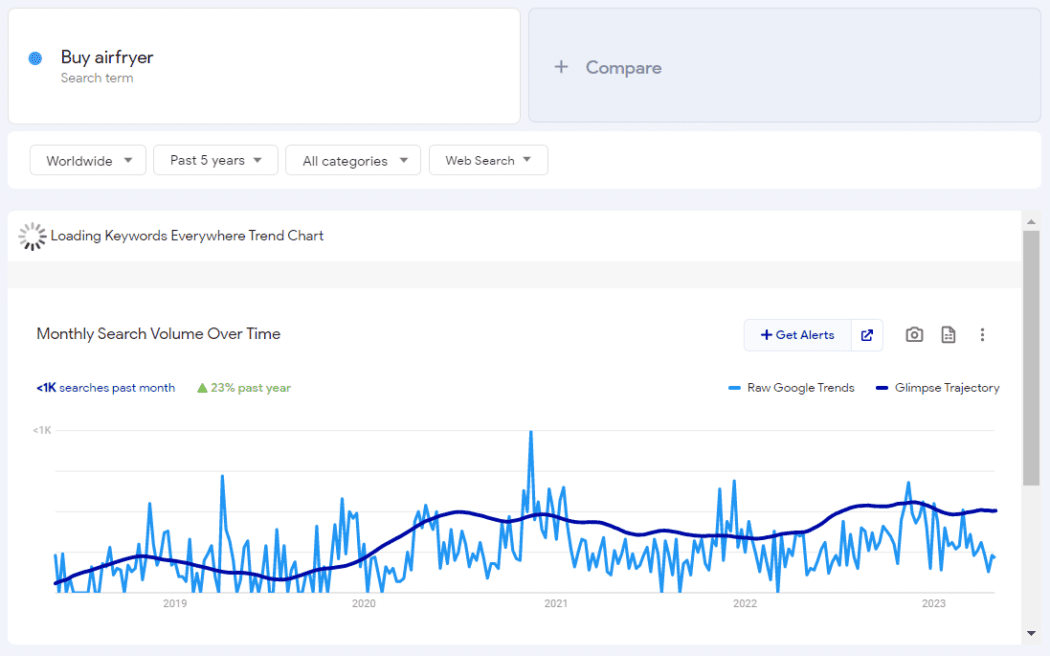

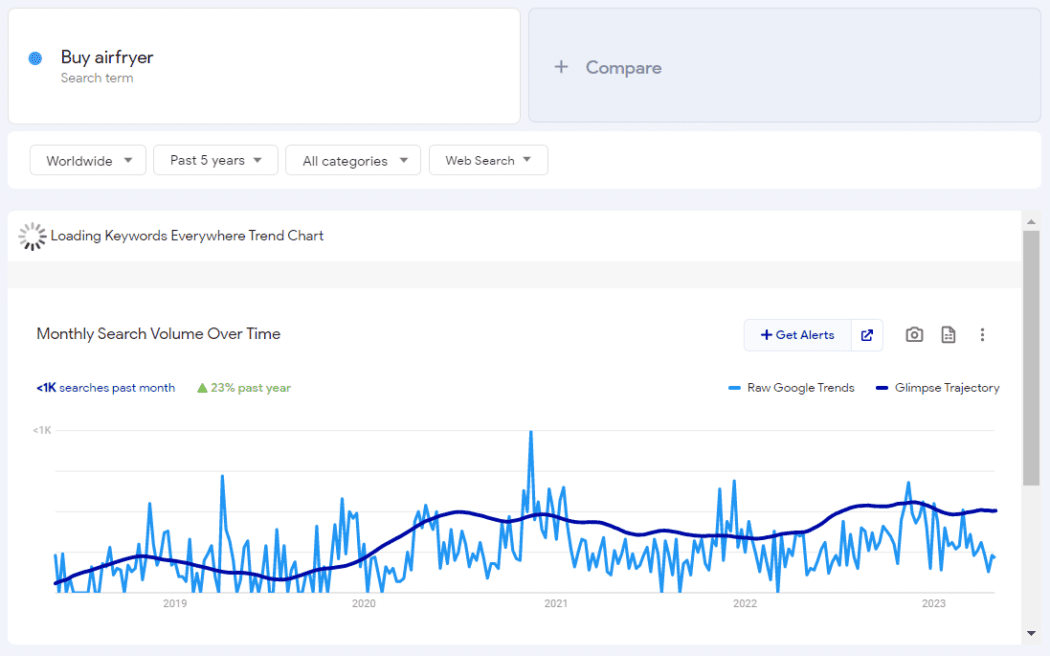

Searches for air fryers, on the other hand, increased in 2020 and have remained relatively stable ever since.

Choose a niche and product

If you’re starting your online selling venture from scratch, it’s best to start with a niche product or service.

Niching allows you to build out an audience looking to solve a specific problem. You will get to know your buyer deeply, and only then can you provide them with all the reasons why your chosen product or service helps them.

Top tip: it will help if you genuinely like and believe in what you’re selling, especially if you’re going to sell on social media (more on that later).

Choose a platform or create an online store

The key to choosing a platform – or platforms – is not to spread yourself too thinly. If you’ve done your market research thoroughly enough, you will already have an idea of where your audience is hanging out online.

Top tip: consider your time. You are better off covering fewer platforms well than covering many badly. You can always scale later.

Market and sell

Once you’ve covered the above, it’s time to jump into your marketing plan. You’ll need a marketing plan that considers the buyer funnel. Think about the content you need to create to persuade prospective customers to buy from you. You will also want to build trust as part of your marketing strategy.

Top tip: sites like Reddit and Quora are free and provide insight into your audiences, their problems, their issues with competitors and so much more. The same applies to Google’s People Also Ask.

Sticking with the idea of selling air fryers, a quick search of the word ‘air fryers’ returns commonly asked questions about pros and cons.

Popular platforms where you can sell products online

Now that you’ve got your marketing plan started, it’s time to choose a platform for selling online.

Sell on your own online store

You can’t sell online without a digital store or platform. While you can sell on social media (more on this later), an owned channel like a website can become an asset over time.

Here’s some guidance on setting up your own platform.

Choose a domain

Check your desired domain name is available and buy online. Your domain name should be the same as your business name. It should be memorable, easy to spell, and relevant.

Create your store

Create an online store using GoDaddy’s Website Builder and set up shop within a day. You can add products, take payments and sell online from anywhere in the world.

Add payment processing

You need to integrate your online store with a payment gateway to accept payments. The gateway you choose comes down to personal preferences, terms and conditions and transaction fees.

PayPal is free to integrate but may charge a higher rate per sale, but if you want to test your ecommerce store before committing to a gateway like Stripe, PayPal can be a good start.

Manage inventory

Inventory management is crucial for any ecommerce business, especially if you receive orders online. If you have physical products, your inventory must match what’s available online; otherwise, your risk selling more products than you have in stock, resulting in disappointed customers.

If you’re selling online and offline, stock inventory can get more complicated as you must regularly update your online inventory. Larger businesses have inventory management systems for this, but as a start-up, you can sometimes manage inventory updates with good administration.

Choose a shipping provider

Shipping can get rather complex, especially if you’re planning on handling international orders. You need to think about shipping costs and how you will manage them. Some businesses choose to absorb shipping so there’s no obvious cost to the buyer. Of course, if you do this, shipping costs should be factored into your product price.

Shipping calculations vary, but here are some options.

- Flat-rate shipping is as it sounds. The business charges the same shipping cost for all packages, regardless of weight or distance. Flat-rate shipping should be carefully monitored. With a flat rate, your business expects to profit on some purchases and lose on others, especially if you’re shipping internationally. Flat-rate will only work if the profits and losses are approximately balanced.

- Actual cost is a calculation where the business calculates the exact shipping cost for each package and charges this to the customer. This is usually done automatically at checkout using a shipping calculator. The calculation will take into account location, weight, size and more.

You can incentivize a purchase with free shipping, and you can also offer more expensive shopping options for faster delivery.

Top tip: Test your shopping experience before you start. You must ensure your prospective customers have a seamless experience from finding you to buying. That means no broken checkout.

Sell on Marketplaces

Marketplaces like Amazon, Etsy, eBay and Craigslist offer excellent opportunities to reach a broad audience and sell your products. Service-based businesses can try Freelancer, Upwork, Toptal and more.

You can sell on many of these marketplaces and your website. You can try the marketplaces and see how they perform.

Naturally, each marketplace will take a percentage of the sale, so you’ll need to factor that in.

Amazon

Any ecommerce brand should at least try out Amazon. It is a search engine for products, and some of your buyers will go to Amazon before Google.

Pros

- Amazon is one of the largest ecommerce marketplaces.

- It’s simple to set up a seller account and list your products.

- Users may use Amazon as a search engine rather than Google, so you’re reaching a new audience.

Cons

- Amazon has over two million sellers, so you need good product photography to stand out.

- For users to find you on Amazon, you need to know a little about Amazon SEO.

Etsy

Etsy is a popular marketplace for crafts, handmade and vintage products. But Etsy is also an excellent marketplace for digital products like guides, ebooks and more.

Pros

- If your product is crafty, handmade or vintage, you can know that users are heading to Etsy to find it.

- It’s cheap to start selling.

Cons

- It is a busy marketplace with lots of sellers.

- You don’t have the same control over your Etsy store as you do your store.

- Customers often expect personalization on Etsy.

eBay

eBay is one of the oldest ecommerce marketplaces. By now, most of us have probably sold (or tried to sell) something on eBay.

Pros

- It’s familiar.

- You may already have an account with some reviews to build trust.

Cons

- eBay’s UX isn’t as friendly as some alternatives.

Craigslist

Craigslist is a classified advertisements website that allows you to sell products locally.

Pros

- There are no fees

- You can sell locally, which helps with shipping fees if you want to keep your business geographically small.

Cons

- Local sales only can be limiting once you have the desire to grow.

Sell on social media

Once the products or services are available to buy, your first task is to drive traffic to the site. Here are some tips for promoting and selling your products digitally.

Social media

Social media is a great place to build an audience and, importantly, a brand. Through social media, you get to know your audience, and they get to know you; social media is personal.

TikTok

TikTok is a platform credited for its generous algorithm providing accounts with excellent reach. As one of the fastest-growing platforms with over 1 billion users, your audience is likely hanging out there.

Mia Steele is a TikTok creator who began monetizing content in April 2022. She reports great success on the platform.

Steele says, “In less than six weeks of posting on TikTok and diving into User Generated Content (UGC), I began monetizing my content. I managed to replace my income by creating content and ads for brands.

“As my TikTok following grew, I even sold my own digital products to my audience.”

Steele’s top tip for a successful social media account is, ‘Devote time to cultivate and nurture your own audience, so you can capitalize on the traffic to sell your own products.’

TikTok also has TikTok Shop that you can access once you have 1,000 followers. TikTok Shop allows you to take a commission from items promoted and sold within your videos.

Facebook and Instagram

Like TikTok, you can grow an audience on Facebook and follow the path of selling digital products. Facebook and Instagram also have Shop functionality to sell products directly on the platform.

Facebook and Instagram benefit from the ability to post from Instagram to Facebook automatically, which will save you time.

Pinterest allows you to create a shoppable feed to list your products and sell them directly on the platform. You can also use Pinterest to drive traffic to your online store or blog.

Pinterest marketer Kayla Ihrig says, “The best way to make money on Pinterest is by making pins that lead to your services or products. Unlike other platforms where you need to constantly share valuable information to market your product or service, on Pinterest, users are searching for it and just want to be able to find it. Creators need to create images or videos (called pins) that display what they offer and then optimize them for search. Then, when a user searches for a solution to their problem, they find your content and go back to your website.”

Ihrig’s pin, pictured below, is the perfect example of a pin that leads a user to her service-based site.

Selling on social media opens a window of opportunity for entrepreneurs. You can sell your own products and services or explore affiliate and email marketing, which you can advertise in tandem with your platform.

Affiliate marketing

With a combination of your website and social media, you could sell products online without actually owning or stocking a single item. Ideal for the entrepreneur craving ultimate freedom.

With affiliate marketing, you take a percentage of sales made via your channels using trackable affiliate URLs.

Mia Steele drives traffic from her social media following of 20,000 to her website. She started with a domain name from GoDaddy and started her journey into affiliate marketing. Steele says, “Within just seven months, I had joined more than 15 affiliate programs, built an email list of over 3000 subscribers, and earned over $90,000 in commissions by promoting products on TikTok and through my blog.”

The key, Steele says, is “Building your email list from day one. I underestimated the power of an email list until I ventured into affiliate marketing, and I regretted not starting earlier. Having a compelling free lead magnet and consistently producing high-quality content to drive traffic to your offers will be the key to your success.”

Email marketing

Email marketing is a cost-effective way to reach your target audience and promote your products. Done well, every email you send can make money. At least, this is the case for the team at Siligrams.

Arlene Battishill, Chief Marketing Officer, says, “Our email marketing is killing it with an average 55% open rate. Every email makes money. A recent email marketing campaign – a series of 10 daily emails – had an average 63% open rate because the campaign was nothing but stories and bad jokes and had absolutely nothing to do with our product!”

The secret to Battishill’s campaigns is consistency and humor; not every email is a sales plea that likely contributes to the sales success. Siligrams choose to humor and engage their audience instead of going for a hard sell. Remember, people buy from people.

Top tip: you can create and send stylish emails in bulk using GoDaddy’s marketing suite.

Trust the process when selling online

If it were easy, everyone would do it. Although the online selling path is simple, it requires dedication. Commit to your product, trust the process and be consistent.

As a budding entrepreneur, you have a lot to explore, and a platform that works for one business may not work for another, so be bold and experiment.

Sell online FAQ

Finally, we’re answering some of the most asked questions when it comes to selling online.

How do I sell online for the first time?

Your first online sale is the result of small steps made consistently. Follow the steps in this guide, from idea generation and market research to marketing and set-up, and you will make your first sale.

What are the most profitable items to sell online?

The most profitable items to sell online vary based on trends, but some items stand the test of time. These items include SaaS products via affiliate marketing since you earn recurring revenue.

For physical products, you can explore items in the following categories:

- electronics

- fashion accessories

- beauty products

- home decor

- health and wellness

Naturally, these categories are also some of the most competitive, and you should consider the challenges. For example, electronics can go wrong, resulting in customer service issues and refund requests. Health and wellness is challenging to build authority in, especially if you’re relying on a new, owned website to sell from.

How can I sell products online legally?

The legal requirements for selling online can vary, and you must research to ensure you comply fully with laws and regulations. You must consider registering your business, correctly paying your taxes, and customer privacy and security. Advertising online also requires you to adhere to rules and regulations, from product information to the types of images and ad copy.

What is the easiest platform to sell online?

Ease of use is a priority for any platform that allows you to sell online. You can set up an eBay, Etsy or Amazon store within a day. The platforms are already geared to helping people like you sell.

If you want to own your platform, which is not a good idea, website builders help you set up shop as quickly and efficiently as possible.

Starting A Business

Guide to Starting a Transportation Business: Key Steps and Strategies

Published

8 months agoon

May 26, 2023

Did you know that the transportation industry relies heavily on the trucking sector for 72.5% of its freight transportation? That’s a lot of goods being moved around the world on the back of trucks!

And guess what? The future looks even brighter for this industry. Experts predict the global transportation industry will experience a compound annual growth rate (CAGR) of 38.5% until 2027.

With such promising statistics, it’s no wonder that starting a transportation business can be a smart decision. Whether you dream of running a taxi service, delivering packages to people’s doorsteps, or even managing a logistics company, the opportunities are endless.

Whatever business option you may select, in this article, we’ll walk you through the key steps and strategies to help you kick-start your transportation business. So, let’s begin!

Conduct Market Research

Before diving into the transportation business, it’s crucial to conduct market research to understand the demand, competition, and potential opportunities in your target market. It’ll help you make informed decisions and tailor your services to meet customer needs effectively. Let’s explore this step further by asking three important questions:

1. Who are your potential customers?

To identify your potential customers, consider demographics such as age, gender, location, and income levels.

For example, if you plan to start a rideshare service in a college town, your target customers might be students looking for affordable transportation options.

2. What is the level of demand for transportation services in your area?

Assess the existing transportation options in your area and determine if there’s a demand gap.

For instance, if you discover that there’s a high demand for medical transport services for the elderly population, you could explore starting a specialized medical transportation business.

3. Who are your competitors, and what sets you apart?

Learn about the leading service providers in your area and how they operate their business. Analyze their strengths and weaknesses and determine what unique value you can bring to the table.

For instance, if you’re starting a courier service, you could differentiate yourself by offering faster delivery times or specialized handling for fragile items.

This way, you can gain valuable insights into your target market, understand customer preferences, and develop a competitive edge.

Create a Business Plan

Needless to say, every successful business starts with a well-crafted business plan. It serves as a roadmap, outlining goals, strategies, and financial projections. Ultimately, it helps one stay focused, secure funding, and make informed decisions.

So, to kick-start your business, you must take time and create a robust business plan. Make sure to include details such as your target market, competitive analysis, marketing strategies, operational procedures, and financial forecasts.

Also, be realistic and thorough in your projections, such as considering expenses like vehicle acquisition, maintenance, fuel, insurance, and marketing costs. Agree or not, it will come in quite handy when pitching the investors.

Obtain the Necessary Permits and Licenses

It doesn’t matter what industry you are a part of; complying with legal requirements is a must for the smooth functioning of the business. So, contact your local government or transportation authority to understand the permits and licenses necessary for your specific transportation service.

This may include commercial driver’s licenses, vehicle permits, insurance coverage, and business registrations. You must meet all these legal obligations before launching your business.

It will not only help avoid any legal issues down the road but will also demonstrate your commitment to operating a legitimate and compliant transportation business. It also builds trust with your customers, who expect an honest and reliable transportation service.

Acquire Vehicles and Equipment

The backbone of your transportation business will be the vehicles and equipment you’ll use. Not only do you need reliable vehicles to transport passengers or cargo, but you also need to ensure that they are well-maintained to avoid service disruptions.

According to professionals at Auto Glass Zone, one crucial aspect of vehicle maintenance is taking care of the glass components, such as windshields and windows. It’s because these provide visibility and safety for both drivers and passengers.

But, continuous exposure to road conditions and weather elements can damage chips, cracks, or other glass. That’s why it is essential to promptly repair or replace any damaged glass to maintain the safety and integrity of your acquired vehicles.

In addition to this, consider factors such as fuel efficiency, maintenance costs, and cargo capacity when acquiring vehicles and equipment for your business. Continuing the example above, if you’re providing courier service, you may also need equipment like hand trucks, dollies, or refrigeration units.

Build a Strong Network

Apparently, networking plays a vital role in the transportation industry. It involves establishing relationships with suppliers, clients, and other businesses in related industries. It opens doors to collaboration, referrals, and valuable partnerships.

For example, connecting with a local delivery service can lead to partnership opportunities where you can combine forces to provide comprehensive logistics solutions. Additionally, maintaining a strong online presence through a professional website and social media platforms allows you to showcase your services, attract customers, and engage with your audience.

Even so, keep in mind that networking is a two-way street. So, be proactive in reaching out, be a reliable and helpful partner, and nurture your connections.

Focus on Customer Service

Last but not least, when running a successful transportation business, one of the most critical aspects is providing excellent customer service.

Why is customer service so crucial? Well, imagine you’re a passenger in a taxi or waiting for a package delivery. How would you feel if the driver or delivery person was rude, unhelpful, or unresponsive? It would certainly leave a negative impression and make you think twice about using that service again, right?

Focusing on customer service can set your business apart from the competition and build a loyal customer base. So, train your staff and promptly address customer inquiries and concerns. You can also consider implementing technology solutions like GPS tracking systems or mobile apps to improve efficiency and communication with your customers.

![]()

Final Words

Starting a business requires dedication, perseverance, and adaptability. So, stay informed about industry trends, continuously evaluate and improve your operations, and be open to learning from your experiences.

With the right strategies and a passion for providing reliable transportation services, you can navigate the road to success in the transportation industry.

Starting A Business

Want to Start a Business in France? Four Key Tips for American Entrepreneurs

Published

9 months agoon

May 2, 2023By

Newsroom

For many Americans, the prospect of France is a romantic one, with hugely popular films and TV series like Amelie, Chocolat and Emily in Paris cementing France’s reputation for glamour, charm and indulgence. But while the appeal of France’s lifestyle and culture is undeniable, the country also offers something that’s less well known – a swath of business opportunities ready to be seized by internationally-minded American entrepreneurs.

With an estimated 4,500 American companies already operating in France, it’s clear that the country is an attractive prospect to American business people, and there is the potential for great success in La République française. However, if you want to start a business in France (or expand there) as a US citizen, it always pays to know as much as possible beforehand in order to plan thoroughly, avoid common pitfalls and give your business the best chance of thriving.

Why France?

As the third-largest economy in Europe (and seventh in the world), there is a long list of reasons why France is so appealing to business people, some of which include:

- France is a vibrant and diverse nation that boasts a skilled workforce, a large consumer population and access to the world’s largest trading bloc through its membership of the European Union.

- It is also welcoming and business-friendly, with the French government offering financial incentives to both new and established businesses and investing heavily in research and development.

- France has a strategically useful location buttressed by a highly developed transport infrastructure, greatly contributing to ease of travel and transit both within and outside of the country. London, for example, can be reached in under 2 and a half hours by Eurostar from Paris.

- France isn’t only large in terms of its economy – by surface area, France is the largest country in Europe and is made up of thirteen regions that all represent unique opportunities for entrepreneurs. It also borders eight countries and has a Channel, Atlantic and Mediterranean coast.

- An international centre of business, the Paris region enjoys global status as a major business hub, and is the number one region in Europe for hosting the world’s top 500 corporate headquarters.

Five Tips For Starting Your Business in France

One: Be prepared to navigate bureaucracy

For foreign company founders from outside the EU, the EEA or Switzerland, there are predictably some i’s to dot and t’s to cross when setting up a company in France, and the process can take some time. That being said, however, France is welcoming enough to entrepreneurs that you may find there are fewer hoops to jump through than you first expect, and there are many resources you can access to ease the process.

Anyone can establish a business in France by taking steps such as registering a business address and opening a bank account in the country, but if you would like to move to France to embark on your new venture you should apply for a long-stay visa known as the “Entrepreneur/Self-Employed” (VLS-TS) temporary residence permit.

Eligibility is determined via factors such as your ability to provide evidence that you will be engaging in an economically viable activity during your stay, and when it has been approved, the visa authorises residence for 12 months. During this time, you are allowed to live in France and engage in the commercial activity that you have outlined in your application.

This will involve a trip to the French consulate, of which there are ten across major cities in the USA. Once established, you will have to register your French business according to the correct category of your enterprise. It is also important to bear in mind that France has particular regulations across various business sectors and employment practices, and that corporate banks in France require minimum capital investments.

Two: Start learning the language

With a population that has originated in every corner of the globe, multilingualism is not unusual in the USA – one in five US adults speak a language other than English at home, (of which Spanish is the most common). But while the USA has no official language, it’s fair to say that English is the de-facto, and most particularly in the business world.

It is also the case that English is the most widely understood language in the EU, and a significant proportion of Europeans speak English as their second language (with an impressive 25% able to hold a conversation in two additional languages to their mother tongue). What’s more, 39% of French people report they are able to speak English, and many ex-pats move to the country without being able to speak French.

Despite this, it would be wrong to assume that you can easily default to English and thrive while running a business in France. The population of France primarily speaks French in both personal and professional contexts, and the French people have considerable language pride.

English might be widely spoken in business circles, but demonstrating your willingness to learn and use French phrases of greeting will be greatly appreciated, and you should bear in mind that proficiency in English is not a given. Over time, many ex-pats discover that shaping up their French language skills is key to taking advantage of everything the country has to offer.

You should also account for the fact that French is the only accepted language for official documents and contracts, and as 61% of French people don’t speak English, you will need a plan for smoothing over language incompatibilities in your business operations.

Three: Consider your new audience

In many important ways, France is not vastly different from the US, but it is still important not to underestimate cultural differences when setting up or expanding a business here. While certainly smaller than the US, it’s also important to remember that France is far from small by European standards, and like the differences between US states, there is significant regional variability across the country.

Whether it’s something simple such as the greater prevalence of smoking amongst French adults (around 33% versus 12% in the US) and the lack of a widespread tipping culture, or more complex subtleties in language, politics and history, there are many things that may be surprising about France as an American. This is why we would suggest seeking the advice of those who know the country well in many points of your business to understand how it may land with a French customer base.

There are also differences in laws and regulations which may affect your business, so it’s always worth doing thorough research as you draw up your French business plan to identify and account for factors which may not apply in the USA.

Four: Understand France’s working culture

American working culture is rather set apart from its European friends, with US citizens generally working longer hours, having less vacation time, and eating lunch (if they don’t skip it) at their desks. It also isn’t unusual for people to take calls and answer emails outside of work hours, and employers tend to have more flexibility when it comes to hiring and firing.

The French, on the other hand, tend to have a more leisurely pace of life which is facilitated by both government-mandated workers’ protections and the expectations of their working population at every point of the pay scale. This may take some adjustment when running a business and is something you’ll need to plan around – but the upside is, if you have chosen to live in France, you’ll get to enjoy this slower pace of life too!

Some things to take into account regarding French working culture are:

- The French will take their lunch break away from their desk, so unless you organise a specific lunch trip, this is a bad time for calls, meetings and emails (if you need an immediate response).

- They don’t only have significantly more holiday entitlement than Americans usually enjoy, they actually take it (whereas the average US employee who receives paid vacation only actually takes 54% of the allotted time each year.) This is usually most evident in July and August, when business slows down considerably, and as many employees will book more time off around public holidays, it pays to plan around these times of year.

- Since 2017, managers and employees of companies with more than 50 staff have not been required to answer emails outside working hours, and employees in smaller companies are likely to follow suit.

- French corporate operations are, for the most part, very hierarchical. When doing business with another company, take the time to understand the chain of command to ensure you are talking to the right people in order to get results.

- Hiring in France is an expensive proposition. Employers must account for high individual taxes when determining employee wages and the slate of employment benefits they are expected to provide. While these costs are high, however, people doing business in France tend to be repaid with a skilled and secure workforce.

- Networking is often key to success in the French business world, with personal recommendations often meaning more than accolades and titles. Forging business relationships in France can be more difficult than in America (although the collaborative nature of American business may give you a ready-made advantage), but they tend to last for a long time, making them well worth the effort.

There is a world of opportunity to be discovered by American entrepreneurs who take the plunge and start a business in France, and with proper research, a comprehensive business plan, and that famous American work ethic, success à la française can be well within your grasp.

This post was written by Katya Puyraud, a company formation expert at EuroStart Entreprises, who help entrepreneurs start a business in France and take the headache out of opening a company abroad.

Landed For Success Showcases Inspiring Stories By Dr. Tom Chesser Achieving #1 International Bestseller Status In Canada, United States, Mexico, Europe & Asia

Bob Chitrathorn Renews Membership with the Financial Services Institute

Ryan Quante, Founder of Care Income Advisors, Interviewed on the Influential Entrepreneurs Podcast Discussing Dementia Care

Hiring a Remote Worker? It Takes More Than an Internet Connection

Flexible, shorter-term apartment startups gain more traction

Six Office Remodels That Will Help Improve Work Culture

Trending

-

News3 days ago

News3 days agoRyan Quante, Founder of Care Income Advisors, Interviewed on the Influential Entrepreneurs Podcast Discussing Dementia Care

-

News5 days ago

News5 days agoSensationally Wired Launches the NeuroSoothed Sleep Method Course, Offering Transformative Techniques for Improved Sleep

-

News3 days ago

News3 days agoBob Chitrathorn Renews Membership with the Financial Services Institute

-

News3 days ago

News3 days agoJohn Martin with Compass Wealth Strategies Interviewed on the Influential Entrepreneurs Podcast Discussing Using Life Insurance for Retirement

-

News2 days ago

News2 days agoLanded For Success Showcases Inspiring Stories By Dr. Tom Chesser Achieving #1 International Bestseller Status In Canada, United States, Mexico, Europe & Asia

-

News3 days ago

News3 days agoDOSS Celebrates Significant Milestone: First DOSS Home Center Franchise Opens in Flower Mound, Texas

-

News3 days ago

News3 days agoDr. Annette Greenwood Empowers Women Over 50 to Triumph Over Adversity and Rediscover Life’s Magic