Bob Chitrathorn discusses tips on claiming social security.

Listen to the interview on the Business Innovators Radio Network: https://businessinnovatorsradio.com/interview-with-bob-chitrathorn-co-founder-of-simplified-wealth-management-discussing-social-security-claiming-options/

Social Security is an important retirement benefit that many people rely on as a major source of income during their golden years. However, with so many different options and rules surrounding Social Security, it can be confusing to navigate. Here are some helpful tips for claiming Social Security:

- Understand the Basics: The first step in claiming Social Security is to understand the basics. This includes knowing people’s full retirement age, which is typically between 66 and 67 years old depending on the birth year. It’s also important to know that they can start claiming benefits as early as 62, but their monthly benefit amount will be reduced. On the other hand, if they delay claiming until after their full retirement age, their monthly benefit amount will increase.

- Consider the Health and Financial Situation: While it may be tempting to claim Social Security as soon as people are able, it’s important to consider their personal health and financial situation. If they are in good health and have enough savings to support themselves, it may make sense to delay claiming benefits in order to receive a higher monthly amount. On the other hand, if they have health concerns or need the money to cover expenses, it may be better to claim benefits earlier.

- Coordinate with Spouse: If the person is married, it’s important to coordinate their Social Security claiming strategy with their spouse. This is because there are different options available for couples, such as spousal and survivor benefits. By understanding these options and coordinating with the spouse, people can maximize their overall Social Security benefits as a couple.

- Consider Taxes: Many people are surprised to learn that their Social Security benefits may be subject to taxes. This is based on the income level, with higher earners being subject to more taxes on their benefits. It’s important to consider this when deciding when to claim Social Security, as it may affect the amount people receive each month.

- Seek Professional Advice: Given the complexity of Social Security rules and options, it can be helpful to seek professional advice from a financial advisor or accountant. They can help to understand a specific situation and make an informed decision about when and how to claim Social Security benefits.

- Keep Learning: Lastly, it’s important to continue learning about Social Security even after having claimed the benefits. This is because there may be changes or updates to the program that could affect the benefits. Staying informed and educated can help make the most of Social Security benefits throughout the retirement years.

Bob shared: “I help people navigate the process of claiming Social Security with confidence and maximize the benefits for a comfortable retirement. It’s never too early to start planning for the future and understand how Social Security fits into a retirement plan. It’s important to keep learning, stay informed, and make the best decision for a personal situation.”

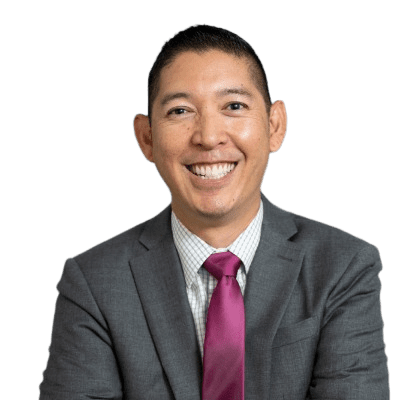

About Bob Chitrathorn

Suthipong Robert Chitrathorn (or Bob for short) came from humble beginnings. Born to parents Puttachart and Sakul Chitrathorn, Bob was raised in a mobile home park in Colton, CA. His parents migrated to Michigan from Bangkok, Thailand in 1974, before settling in Southern California. As a child, Bob didn’t realize how good others had it until he ventured out of the ghetto and went over to friends’ birthday parties. There he’d witness the luxuries of living the American dream and of the possibilities that lay ahead.

To the Chitrathorns, life in America was a gift and they were proud owners of property in America. They worked hard to put food on the table and to put Bob and his younger sister, Crystal, through school. Bob ate sandwiches with nothing but cheese on them, but he was blessed nonetheless. He learned that perspective made all the difference in life.

In his mother’s words, “education is money in the bank.” She teaches nurses still to this day, but she and Sakul, a factory worker, sacrificed to make a better life for Bob and Crystal. They paid for both kids to go through private high school and then helped pay for college.

Their dedication and sacrifice didn’t go to waste. Bob received a full-ride scholarship for his first year at La Sierra University, before transferring to Cal State San Bernardino. He received his B.S. in Finance, as well as a B.S. in Real Estate while minoring in business administration. Despite the rigorous course load, Bob graduated magna cum laude and was named part of the Golden Key Honor Society.

In 2004, Bob became a financial advisor, which was an opportunity to make a good living, while helping others make the best decisions for their own financial lives. He had a short stint at H&R Block and also considered real estate, but he found his passion in personal finance. While Bob was attending CSUSB, his parents were working with an agent at New York Life. Bob always sat in on their meetings. He found that by listening to his parents’ goals and conveying the pros and cons of their decisions, they would listen to him more often than their own advisors.

When Bob became an advisor, it was a no-brainer that Puttachart and Sakul would work with their son, who always listened to their needs. With over 12 years of industry experience, he now has hundreds of clients beyond his parents to guide and influence. Bob recently joined newly established Simplified Wealth Management to help grow a new brand and to help shape the next generation of financial advisors.

In 2016, Bob contributed a chapter to best-selling author and esteemed motivational speaker, Brian Tracy’s book. The book, “Success Manifesto: The World’s Leading Entrepreneurs & Professionals Reveal Their Secrets to Mastering Health, Wealth & Lifestyle,” was an opportunity for Bob to share his love for planning and for his clients.

He holds the Series 6, Series 7, and Series 63 registrations with LPL Financial, and Series 65 registration with Strategic Wealth Advisors Group, LLC, and life, health, and long-term care insurance licenses. Bob has been married to the love of his life, Brittany, for five years. They live in their Riverside, CA home with their rescue dog, Mazy, a pool, putting green, and a Pittsburgh Steelers-themed bar that’s perfect for Sunday Night Football.

If you’re looking for Bob at 6:30 or 7 pm on a weeknight, more often than not, he’s prepping for a case or making phone calls still. His parents’ work habits weren’t lost on him and he’s usually the one at the end of the night setting the alarm and turning off the lights.

Complimentary Power of Attorney

Help with business valuation

Complimentary Second Opinion, investment review/analytics.

Learn more:

https://planwithbob.com/

Simplified Wealth Management, and LPL Financial do not provide legal advice or tax services. Please consult your legal advisor or tax advisor regarding your specific situation.Prior to investing in a 529 Plan investors should consider whether the investor's or designated beneficiary's home state offers any state tax or other state benefits such as financial aid, scholarship funds, and protection from creditors that are only available for investments in such state's qualified tuition program. Withdrawals used for qualified expenses are federally tax free. Tax treatment at the state level may vary. Please consult with your tax advisor before investing

Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

News4 days ago

News4 days ago

News6 days ago

News6 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago

News3 days ago

News3 days ago

News4 days ago

News4 days ago

News4 days ago

News4 days ago